Also, it ensures you possess effective communication skills to discharge your duty as a CPA. This section assesses your understanding of the general business environment and your duties and responsibilities towards it. These reports are used by the stakeholders (investors, creditors/ bankers, public, regulatory agencies, and government) to make investing and other relevant decisions.

Becker cpa pass rate professional#

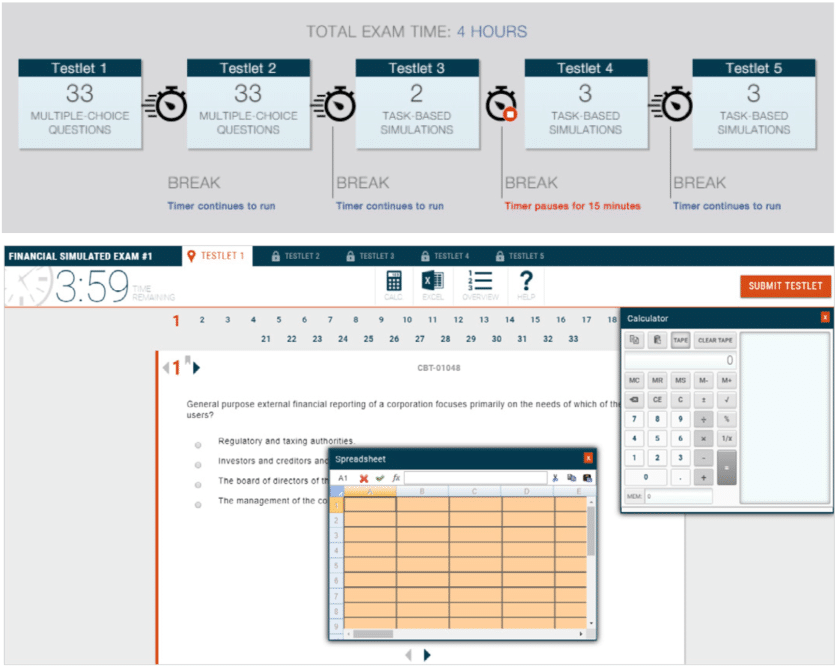

Content AreaĮthics, Professional Responsibilities, and General Principles (Including independence, professional conduct, professional skepticism, and professional judgement)Īssessing Risk and Developing a Planned Response (Including planning, risk assessment, and understanding of business processes and internal controls) The following table lists these areas along with the percentage of the content tested from each one of them. The AUD section includes four content areas. This will help you prepare and schedule your CPA Exam better and maximize your odds of success. This article briefly discusses each of the four sections’ content, format, and structure. You can take the exam in any order that suits your preference. AICPA also offers various sample tests to help you prepare for each exam section. After that, your state board or its designated agent will evaluate your application and contact you. Within 18 months of passing the first sectionĮach time you apply to take one or more CPA Exam sections, submit the required documents and fees to your state board. Throughout the year (continuous testing model) Number of testlets (in each exam section) (requirements may vary as per the state board) Exam particularsġ20-150 credit hours or bachelor’s degreeĪccounting or business-related courseworkĮducation from an accredited and recognized institution The following table outlines the details related to the CPA exams.

Becker cpa pass rate license#

The CPA exam CPA Exam A Certified Public Accountant (CPA) is a US state board-issued license to practice the accounting profession read more is conducted by the American Institute for Certified Public Accountants (AICPA) in coordination with the National Association of State Boards of Accountancy (NASBA). Passing the Uniform CPA exam is one of the requirements to attain CPA licensure. You need to focus on yourself and what you are able to do.The Uniform Certified Public Accountant (CPA) Exam comprises four sections, namely, Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The unique content, structure, format, and scoring of the CPA exam earn it the title of one of the most challenging professional exams.

It would be a better idea to wait until the summer down months to knock out a few sections. You’ll be too busy during tax season to study. You should schedule exams based on your own personal schedule and ability to put in the study time.įor instance, if you work in public accounting, the first quarter might not be a good quarter to take a section. Should I schedule my exam based on the pass rate trends? The obvious answer to that is, no. My passing score letter was the best Christmas present I could have asked for that year.

I think the difference in scoring is simply because people are busier during the holiday season in the 4th quarter and don’t put in enough time to study, so they perform poorly. Nor is there some conspiracy from the National Association of State Boards of Accountancy (NASBA) to lower CPA pass rates at the end of the year. No, the AICPA doesn’t make the exam really hard in the 4th quarter and easier in the 2nd and 3rd quarters. I’m sure you have noticed that all of these graphs look similar with a huge drop in the fourth quarter scores.

0 kommentar(er)

0 kommentar(er)